Content

There’s a lot of information that you’ll need to have in order to file your taxes. Whether you’re working with a tax preparer or going the DIY route, you’ll want to have all your documents in order to make the tax filing process smoother. Don’t miss a thing on your taxes this year by using this easy-to-follow small business tax preparation checklist. If your tax deadline is approaching and you know you’re not going to be able to file on time, request an extension. You’ll need to file the extension before your taxes are due, and depending on your business structure, you might be required to pay any estimated taxes due at that time. 2021 had a lot of ups and downs for business owners, so you may not be ready to file tax paperwork just yet.

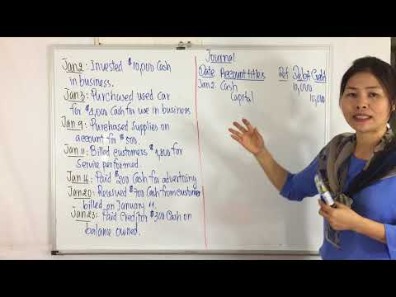

If you use your car in your business and you use it only for that purpose, you may deduct its entire cost of operation, including insurance and maintenance costs, up to the applicable limit. However, if https://quick-bookkeeping.net/ you use the car for both business and personal purposes, you may deduct only the cost of its business use. Preparing taxes as a small business owner can feel overwhelming, but it doesn’t have to be!

Internal Revenue Services

However, the deadline for claiming the credit does not expire until the statute of limitations closes on Form 941. Therefore, employers generally have three years to claim the ERC for eligible quarters during 2020 and 2021 by filing an amended Form 941-X for the relevant quarter. Employers that received a Paycheck Protection Program loan can claim the ERC but the same wages cannot be used for both programs. But tax deductions can help you keep more of the money you work so hard to earn.

- While sole proprietorships are reported straight on the individual’s 1040, Partnerships and S Corporations file a separate tax return to report the income/loss activity of the business.

- Keeping tax documents in a safe place after you file can also come in handy if you get audited.

- Certain business interest expense deductions have increased to 30%-50% of adjusted taxable income.

- Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews.

- As we enter the era of corporate digital nomads and bleisure—business and leisure—travel, it’s likely you or your employees went on business trips this last year.

- Many or all of the products here are from our partners that compensate us.

If you personally earned more than $400 from business activities, it should be reported as self-employed income and paid at the self-employment tax rate. Certain business interest expense deductions have increased to 30%-50% of adjusted taxable income. Our small business tax professional certification is awarded by Block Advisors, a part of H&R Block, based upon successful completion of proprietary training. Our Block Advisors small business services are available at participating Block Advisors and H&R Block offices nationwide. Those who work with business tax preparers should also consult with them to determine the format in which business data should be transmitted for preparation of returns. In order to properly account for the business use of the home, the business owner would first deduct the percentage of the real estate taxes and mortgage interest that would otherwise be taken as an itemized deduction.

Federal Financial Data

If someone takes out a loan on your behalf, but it’s in their name, you are not legally liable for the debt. So you can’t take a deduction on the interest, even if you make all the payments. Most accounting software companies offer some degree of tax support. Read our guide, The Secret To An Easy And Stress-Free Tax Season For Your Business, to learn which tax forms your software supports. If you are filing your taxes yourself, it is incredibly important to do your research and take advantage of every resource possible — including your accounting software. If you hire an accountant to do your taxes for you, he or she will be able to tell you which forms to file.

Download and use the small business tax deduction checklist below to compile all the essentials. Whether you’re tackling your business taxes on your own or hiring a professional tax preparer, this small business tax checklist can guide you in the right direction to make filing your small business taxes easier. Dividend tax reporting is when a corporation pays you property distributions of which you’re a stockholder. When paying tax on dividends from your business investments, your tax rate for qualified dividends is 0, 15, or 20 percent.

Small Business Tax Deduction Checklist

Clearing hundreds of billions of dollars in emergency loans for small business, money received or forgiven through the PPP is tax-free. That means any money your business received and that was allocated toward payroll, rent/mortgage, or utility payments is not considered taxable income. The U.S. tax system is a pay-as-you-go tax system, meaning you need to make tax payments throughout the year and not just at the end of the year. Many small businesses need to make estimated tax payments four times throughout the year to meet their tax obligations. If you make estimated payments, be sure to keep track of those and report them on your tax return, so you don’t end up overpaying your taxes. Under current tax law, many business owners can claim a 20% deduction of their qualified business income.

As interest rates continue to rise and debt becomes more expensive, many businesses want to preserve their cash, and one way to do this is to defer their tax liabilities through their choice of accounting methods. U.S. businesses are facing pressure to drive revenue, manage costs and increase shareholder value, all while surrounded by economic and political uncertainties. Disruptions to supply chains brought about by the pandemic have continued into 2022. Inflation and rising interest rates have made the cost of debt, goods and services more expensive and cooled consumer spending. The stock market has declined sharply, and the prospect of a recession is on the rise.

Get the expert tax help you need.

If you pay rent on your home or apartment, and you work from home full-time, you should claim the home office deduction instead. Over the last few years there’s been a shift to remote work and hybrid work environments. If you 2021 U S Small Business Tax Checklist operate your business out of a home office, you are allowed to deduct the cost per square foot of your dedicated office space. Select the statements that apply to you and see which documents you’ll need to file your taxes.